Loan remaining balance calculator

Enter the mortgage principal annual interest rate APR loan term in years and the monthly payment. If you have a balance of 7500 on your existing credit card and you wish to transfer the balance to a new low-interest card that has a 6000 credit limit you can only transfer 6000 including fees to the new card.

Loan Repayment Calculator

Help With Our Loan Balance Calculator.

. The remaining balance monthly payment and interest rate can be found on the monthly student loan bill. The amount remaining to be paid toward an obligation of loan is known as loan balance. Enter the original Loan amount the full amount when the loan was taken out Enter the monthly payment you make.

The variable home loan balance displayed after the fixed rate term ends includes both. Current remaining pricipal outstanding loan balance. Down Payment - The amount of money that you will be putting down yourself on the car.

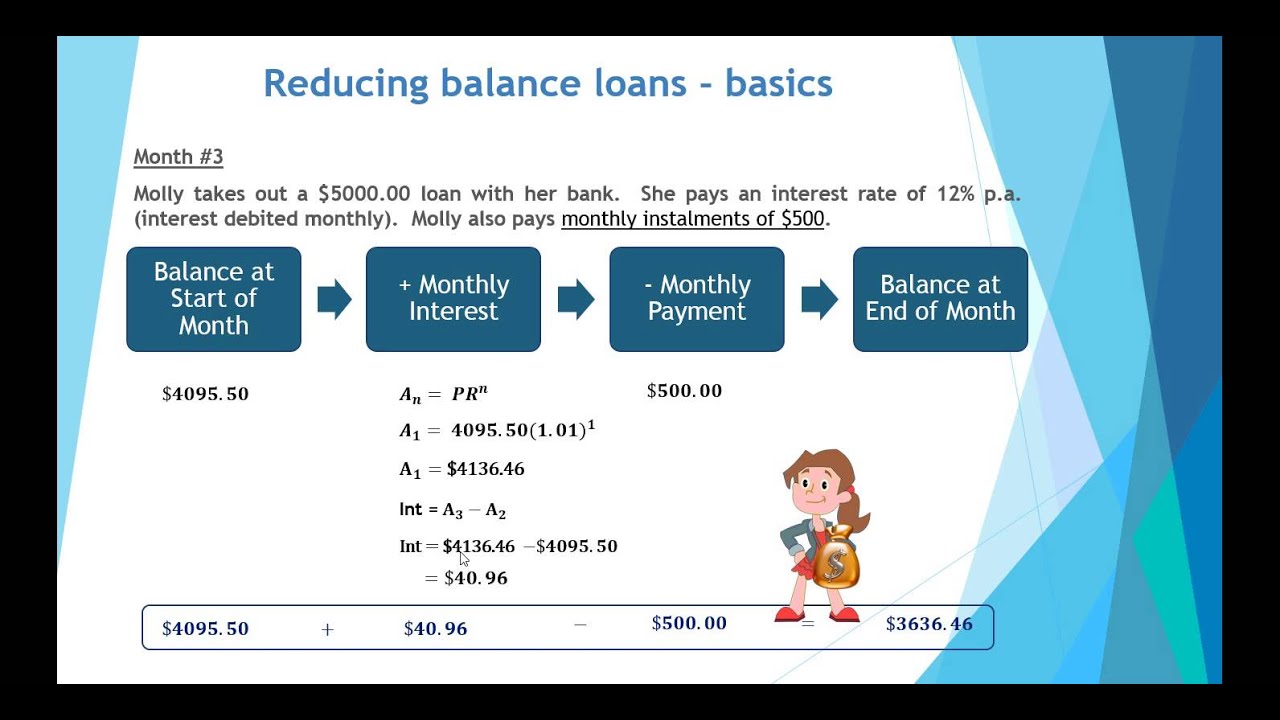

By changing any value in the following form fields calculated values are immediately provided for displayed output values. The remaining balance calculator calculates the principal balance after a specified payment number. Your monthly loan payment amount.

How the Loan Payoff Calculator Works. The first step is to enter the details of the proposed car loan in the fields above. This simple calculator will help you to evaluate your progress through the years of your home loan.

Vehicle Price - The price that you will pay for your vehicle. How much time is left on this loan. Remaining loan term years months.

Lastly to calculate interest outflow multiply the value arrived in step 3 by the rate of interest that was derived in step 1 which would be the line of credit payment of interest. The remaining l oan balance and the APR interest rate youll be paying. The graph displays the total remaining home loan balance over the life of the loan.

Use the calculator below to evaluate the student loan payoff options as well as the interest to be saved. This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis. Enter the annual interest rate.

It is also known as the balance of loan or depositary account. The interest and principal paid the remaining balance and the total interest paid by the end of each month are computed. Y m Any extra amount added to your.

There are additional costs to buying a home that may not be reflected in this calculator. Guide published by Jose Abuyuan on February 12 2020. How different interest rates affect your loan balance.

America is facing a growing debt issue. Use of Loan Payment Formula The loan payment formula can be used to calculate any type of conventional loan including mortgage consumer and business loans. Itll also provide you with an amortization table so you can see just how quickly youll pay down the loan and what your remaining balance will be at any given time.

Our Split Loan Calculator lets you experiment with different split loan scenarios so you can find the best combination of fixed and variable interest rates for your needs. Keep in mind that you cant transfer more than the credit limit on your new card regardless of what your old credit limit was. View full amortization schedule below.

Those 3 numbers will be used to automatically calculate the principal interest portion of the associated mortgage loan. Annual interest rate APR GET TODAYS RATE. This calculator will help you determine the remaining balance on your mortgage.

Yes complete amortization table. Your monthly payment 000. Owed on Trade - If you will be trading in and owe money on that vehicle.

Click the bubble next to the one you want to tinker with first. If youre thinking of applying for a coveted SBA loan to fund your business an SBA loan calculator could help you estimate how much you can expect to repay on a monthly basis. Current Loan Balance the original amount on a new loan or principal outstanding if you are calculating a current loan Interest Rate the annual interest rate stated rate on the loan Remaining Term Months number of months which coincides with the number of payments to repay the loan.

Then choose one of the three options for enteringcalculating the number of mortgage payments made leave two of the options blank and click the Calculate Mortgage Balance button to return your current balance loan payoff amount. Trade In - If you will be trading in your current car put its expected value here. The total payment each period and the remaining balance.

This includes auto RV personal or student loans certain types of promissory notes contracts for deed 1st and 2nd mortgages and so on. From there youll have the option to calculate by monthly payment or c alculate by payoff time. Student Loan Repayment Calculator.

Or given a desired remaining balance the calculator will calculate one of the. 10000 Rate of. Our loan calculator will help you generate monthly and yearly amortiztion schedules for any proposed loan.

How to Calculate Loan Balances with Irregular Payments. One benefit of SBA loans is that they have longer repayment terms compared to other small business loans. Find your monthly payment total interest and final pay-off date.

For the first time in February 2019 the Federal Reserve reported that US. Figure out the accounts opening balance and add up the value arrived in step 2 which shall be the average balance for that billing cycle period. Consumer debt surpassed the 4 trillion mark.

Example if you have a four year car loan and youve made a year and a half of monthly payments 18 months this calculator will tell you the balance of the loan. Paid during the year the remaining balance at years end and the total interest paid by the end of each year are calculated. Bi-weekly Payments for an Auto Loan Calculator.

The results from the calculator are only estimates. Loan balance can be calculated through the online loan balance calculator. To use the loan payoff calculator youll start by entering two critical pieces of information.

You could add other columns like cumulative principal payments made and cumulative interest paid but this is. At this level CNBC notes that Americans spend around 10 percent of their disposable. In the fields provided enter the original mortgage amount the annual interest rate and the original repayment term in years.

Current Monthly Loan. By taking into account the amount you borrowed the interest rate and your repayments you can work out the total amount you will repay for your loan and the remaining balance after a certain number of years. To use it all you need to do is.

The monthly payment and the total interest paid over the life. Your remaining loan balance. Please visit the much simpler Remaining Balance Calculator.

An adjustable rate loan will use the formula shown but will need to be recalculated based on the remaining balance and remaining term for each new rate change. 1000000 Payment Amount P. Our loan repayment calculator gives you an idea of what to expect should you decide to take out a loan.

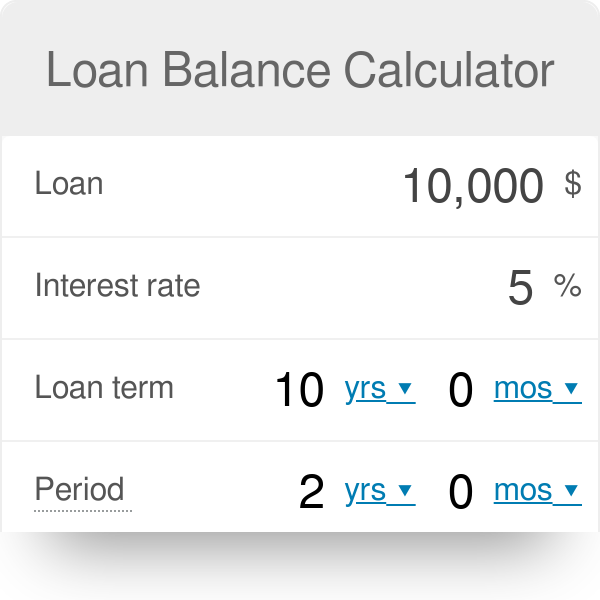

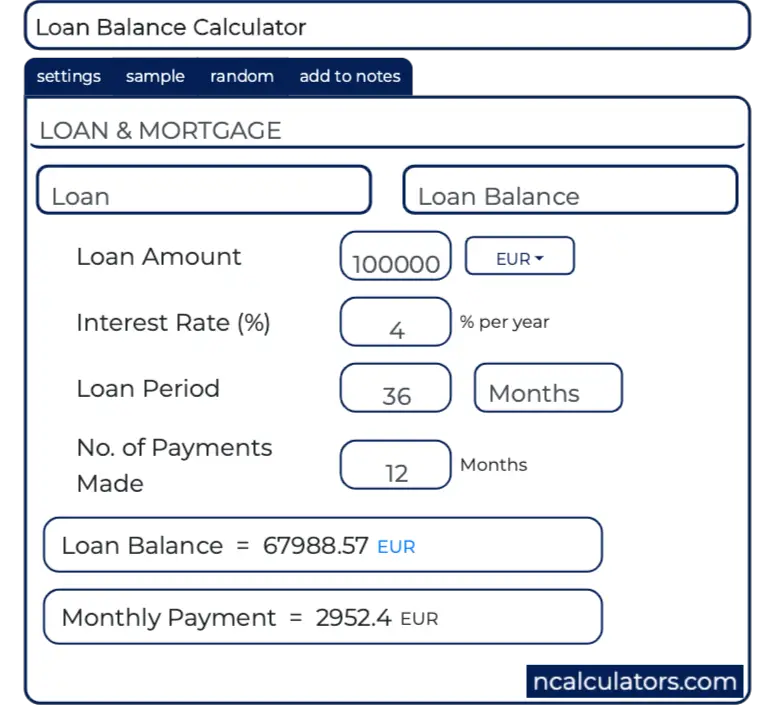

The Loan Balance Calculator can be used to track variable payments on any monthly installment loan. Using our Loan Balance Calculator is really simple and will immediately show you the remaining balance on any loan details you enter. Calculate the loan balance for the given details.

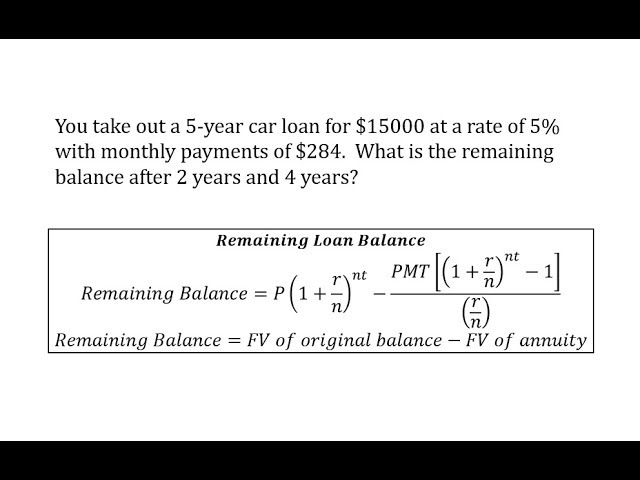

Remaining Loan Balance Formula Car Loan Youtube

Loan Amortization Calculator

Extra Payment Calculator Is It The Right Thing To Do

Outstanding Principal Balance Mortgage Calculator

Mortgage Repayment Calculator

Loan Repayment Calculator

Loan Balance Calculator

Compute Outstanding Loan Balance 5 2 3 Youtube

Student Loan Consolidation Calculator Simplify Your Loans Earnest

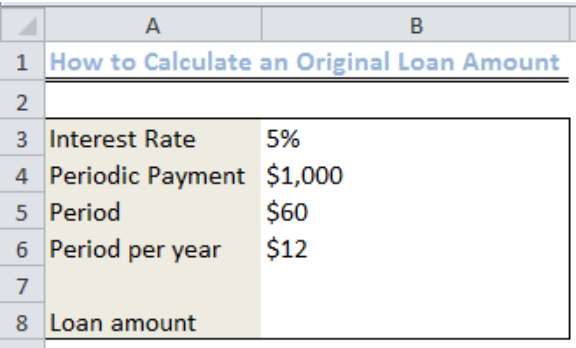

Excel Formula Calculate Original Loan Amount

Calculate Remaining Balance On Loan From Payment Youtube

Solve For Remaining Balance Formula With Calculator

Advanced Loan Calculator

Excel Formula Calculate Payment Periods For Loan Exceljet

Remaining Loan Balance Formula Car Loan Youtube

Loan Balance Calculator

Types Of Term Loan Payment Schedules Ag Decision Maker